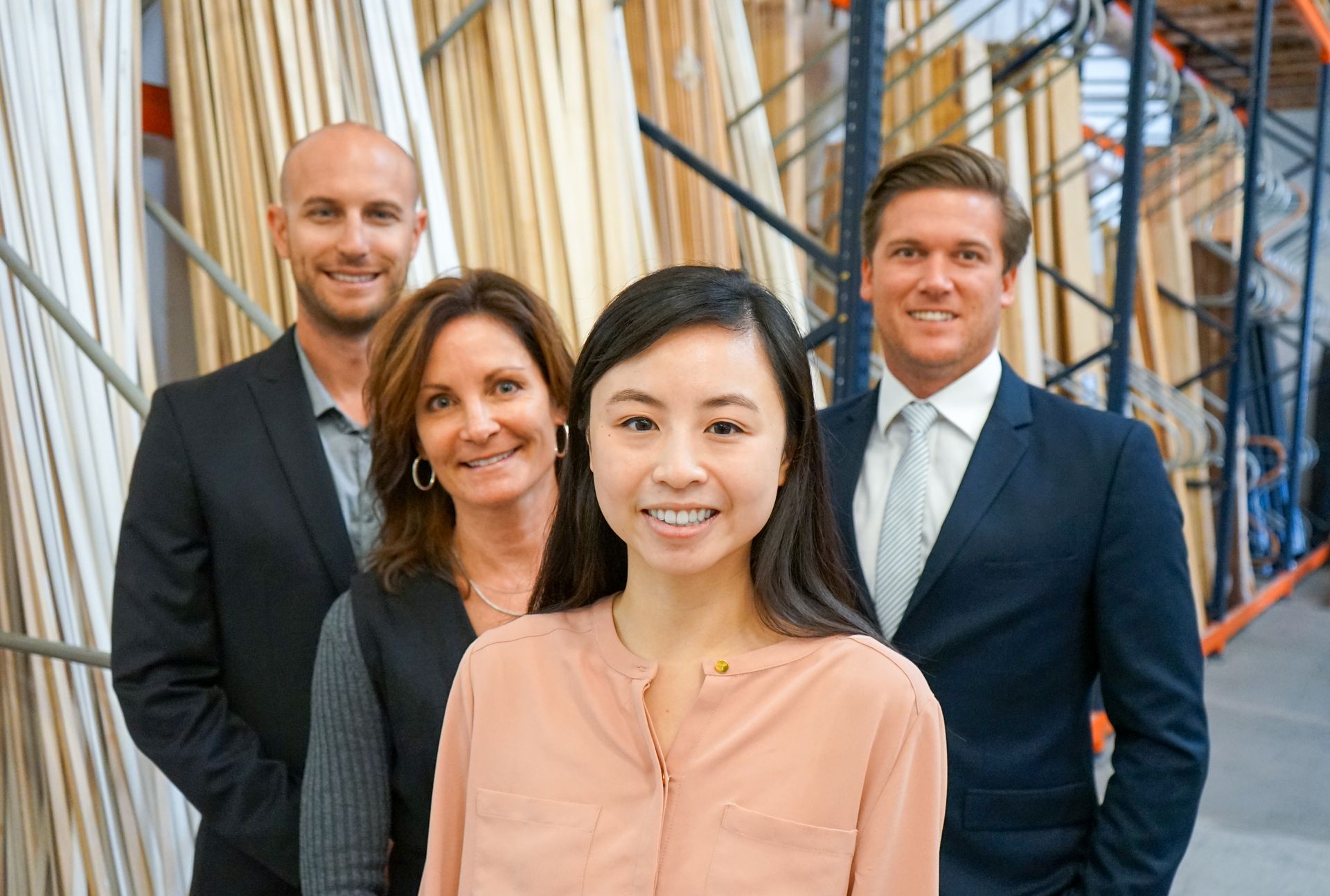

ABOUT US

OUR BELIEFS

LIVE HAPPY

We believe life should be full of celebration and laughter while surrounded by family, friends, and pets, creating memories in our apartment homes for rent. We passionately stand behind the quality of our product and know that our service contributes to enriching the lives of our residents.

LIVE HEALTHY

We believe in a beautiful, balanced, and active lifestyle and that taking care of your health is vital to your well-being. We believe we are accountable for making choices every day that support our health. We are on a mission to share our passion for life and health with all of our residents.